Advertisement

Gusto Wallet

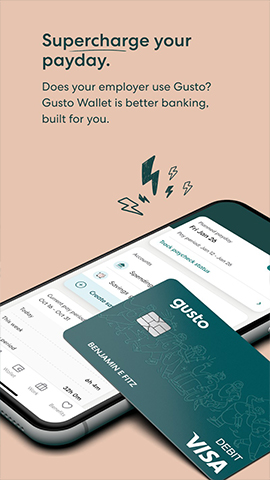

Now employees paid through Gusto can put their money to work with Gusto Wallet.

Gusto Wallet helps you earn, save and spend right within your Gusto account. It’s the easiest way to take control of your financial future.

- Get paid up to two days early with a Gusto spending account [1]

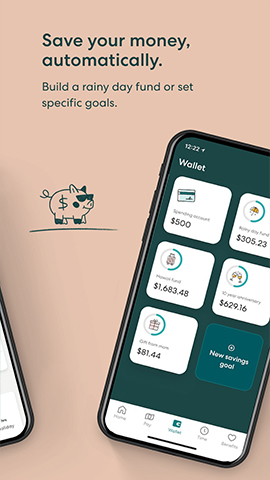

- Save towards custom goals with auto savings

- No minimum balances, account fees, or overdraft fees [2]

- Get a Gusto debit card for simple spending

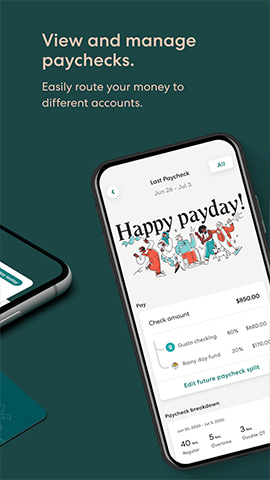

- Route your cash with the paycheck splitter

- Easily view paychecks and tax documents

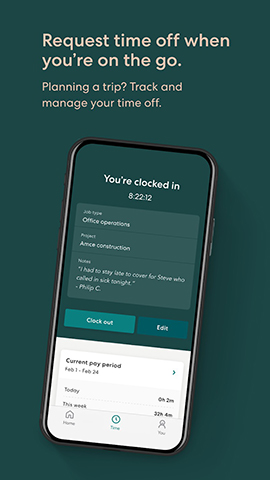

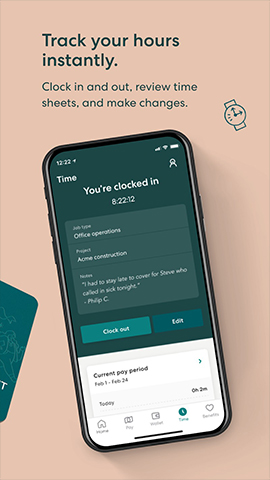

- Clock in and out, review time sheets, and more instantly

We want to make sure you have all the details you need. Here’s some legal info about numbers, who we’re working with, and more:

[1] With a Gusto spending account, your payment may be processed up to 2 days early. Timing depends on when your employer sends payment funds.

[2] Some fees, such as out-of-network ATM and foreign transactions fees, may apply. Check the terms and conditions carefully.

Gusto is a payroll services company, not a bank. Gusto savings goals, spending account, and debit card are issued by nbkc bank, Member FDIC.

FDIC insurance is provided by nbkc bank, Member FDIC. Any balances you hold with nbkc bank, including but not limited to those balances held in Gusto accounts are added together and are insured up to $250,000 per depositor through nbkc bank, Member FDIC. If you have funds jointly owned, these funds would be separately insured for up to $250,000 for each joint account owner. nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your Gusto accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank-list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation.

Advertisement

Advertisement

Advertisement

Introducing cloudplaylab.online, a specialized platform painstakingly designed to offer users an outstanding selection of gaming software downloads. Our mission is to create a secure, intuitive, and all - encompassing gaming resource hub, empowering you to effortlessly acquire the games you adore.

At cloudplaylab.online, we place the authenticity and safety of the games you download above every other consideration. To fulfill this promise, we smoothly link you to the trusted Google Play and Apple App Store for all your gaming requirements. These well - established app stores are the epitome of reliability in the industry, providing access to an extensive library of games and apps while prioritizing user security and privacy.

Understanding that users highly value security and official sources when downloading games, cloudplaylab.online makes sure that every game showcased on our platform undergoes a rigorous screening process. By enabling direct downloads from these official app stores, we present a wide variety of games while significantly minimizing the risks linked to unofficial download channels.

We are truly thankful that you've selected cloudplaylab.online as your go - to destination for gaming software downloads. Whether you're a die - hard Android fan or a devoted iOS lover, we are committed to delivering a premium gaming download experience that is customized to your individual preferences.

Email: [email protected]

Now employees paid through Gusto can put their money to work with Gusto Wallet.

Gusto Wallet helps you earn, save and spend right within your Gusto account. It’s the easiest way to take control of your financial future.

- Get paid up to two days early with a Gusto spending account [1]

- Save towards custom goals with auto savings

- No minimum balances, account fees, or overdraft fees [2]

- Get a Gusto debit card for simple spending

- Route your cash with the paycheck splitter

- Easily view paychecks and tax documents

- Clock in and out, review time sheets, and more instantly

We want to make sure you have all the details you need. Here’s some legal info about numbers, who we’re working with, and more:

[1] With a Gusto spending account, your payment may be processed up to 2 days early. Timing depends on when your employer sends payment funds.

[2] Some fees, such as out-of-network ATM and foreign transactions fees, may apply. Check the terms and conditions carefully.

Gusto is a payroll services company, not a bank. Gusto savings goals, spending account, and debit card are issued by nbkc bank, Member FDIC.

FDIC insurance is provided by nbkc bank, Member FDIC. Any balances you hold with nbkc bank, including but not limited to those balances held in Gusto accounts are added together and are insured up to $250,000 per depositor through nbkc bank, Member FDIC. If you have funds jointly owned, these funds would be separately insured for up to $250,000 for each joint account owner. nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your Gusto accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank-list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation.